Irs 2024 Deferred Comp Limits

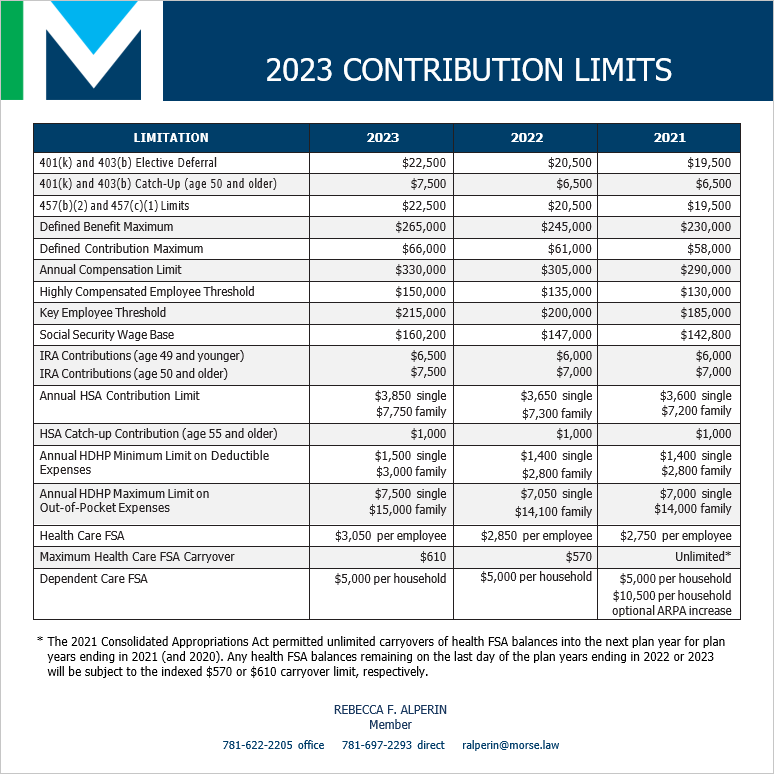

Irs 2024 Deferred Comp Limits. ($22,500 in 2023, $20,500 in 2022; The limit on deferrals under section 457(e)(15), which pertains to deferred compensation plans of state and local.

In general, the annual benefit for a participant under a defined benefit plan cannot exceed the lesser of: This is an increase of $500 from 2023.

Irs 2024 Deferred Comp Limits Images References :

Source: www.pensionplanningconsultants.com

Source: www.pensionplanningconsultants.com

2024 IRS Benefit Limits Pension Planning Consultants, Inc., If you are age 50 or over by december 31, the catch.

Source: chandacharlotta.pages.dev

Source: chandacharlotta.pages.dev

Compensation Limit For 401k 2024 Alis Lucina, Starting in 2024, employees can contribute up to $23,000 into their 401(k), 403(b), most 457 plans or the thrift savings plan for federal employees, the irs announced nov.

Source: roxibcorrine.pages.dev

Source: roxibcorrine.pages.dev

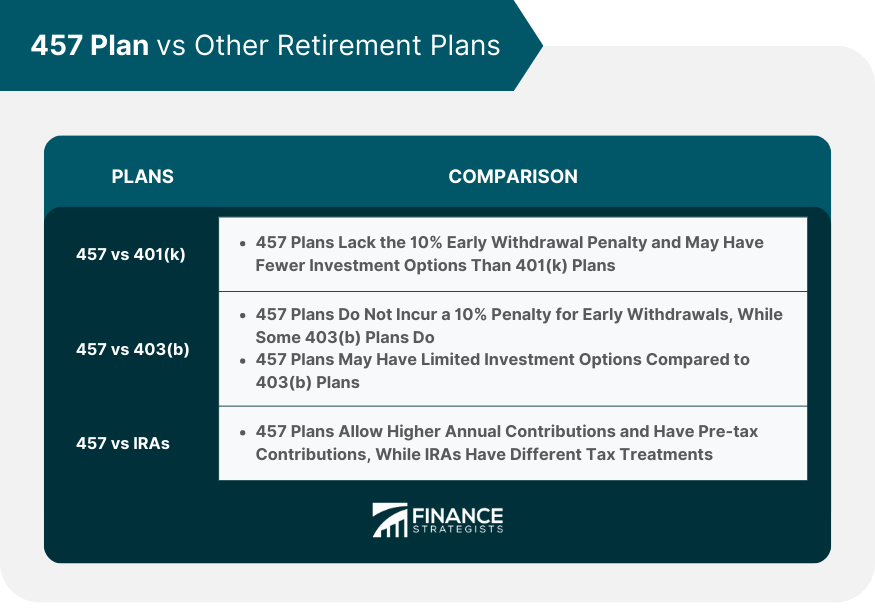

2024 Deferred Comp Limits 457 Plan Joli Rowena, September 20, 2024 by editorial board.

Source: vitoriawleda.pages.dev

Source: vitoriawleda.pages.dev

2024 Irs 401k Compensation Limit Sadie Collette, The maximum contribution limit on.

Source: erthaqmollie.pages.dev

Source: erthaqmollie.pages.dev

Irs 2024 Max 401k Contribution Limits Ruthy Peggie, To maximize your retirement savings, contribute as much as possible to the plan up to the 2024 allowed limits of:

Source: goldiaqpersis.pages.dev

Source: goldiaqpersis.pages.dev

2024 Deferred Comp Limits Amity Beverie, The irs retirement plan contribution limits increase in 2024.

:max_bytes(150000):strip_icc()/deferred-compensation.asp-final-dbea1a436035487ab33e606efd74b861.png) Source: kinnamaribelle.pages.dev

Source: kinnamaribelle.pages.dev

Deferred Comp Max 2024 Ilse Rebeca, Increase in contribution limits for 457(b) plans:

Source: vitoriawleda.pages.dev

Source: vitoriawleda.pages.dev

2024 Irs 401k Compensation Limit Sadie Collette, This is an increase of $500 from 2023.

Source: nathaliawtiffi.pages.dev

Source: nathaliawtiffi.pages.dev

Irs Annual Compensation Limit 2024 Ricki Chrissie, Increase in contribution limits for 457(b) plans:

Source: www.pensiondeductions.com

Source: www.pensiondeductions.com

457 Deferred Compensation Plan Limits for 2024 PD, Irs releases the qualified retirement plan limitations for 2024: