Simple Ira Max 2024 Contribution

Simple Ira Max 2024 Contribution. Simple ira or defined contribution plan, such as a 401(k), you can convert it to a roth ira through. You may contribute up to $16,000 to a simple ira in 2024, up from $15,500 in 2023.

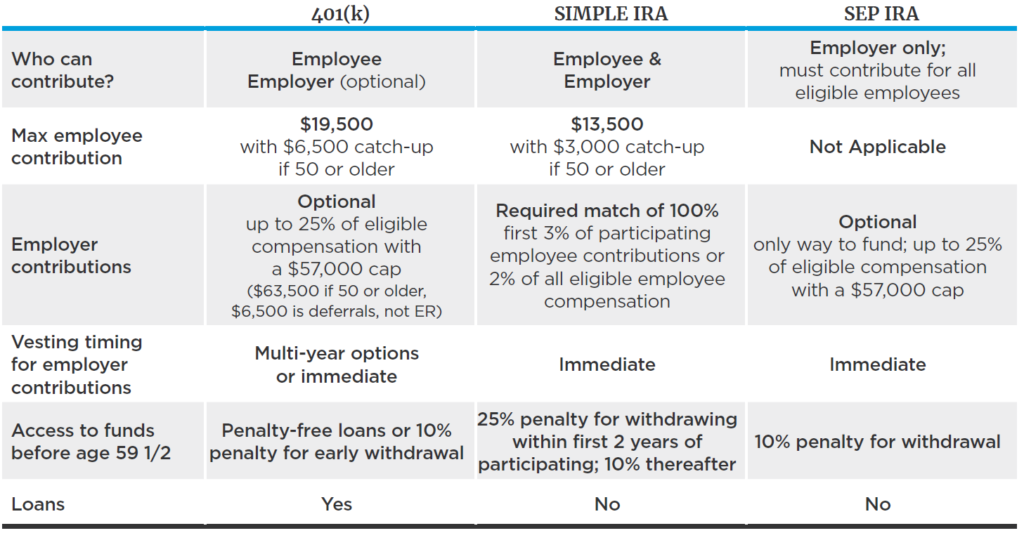

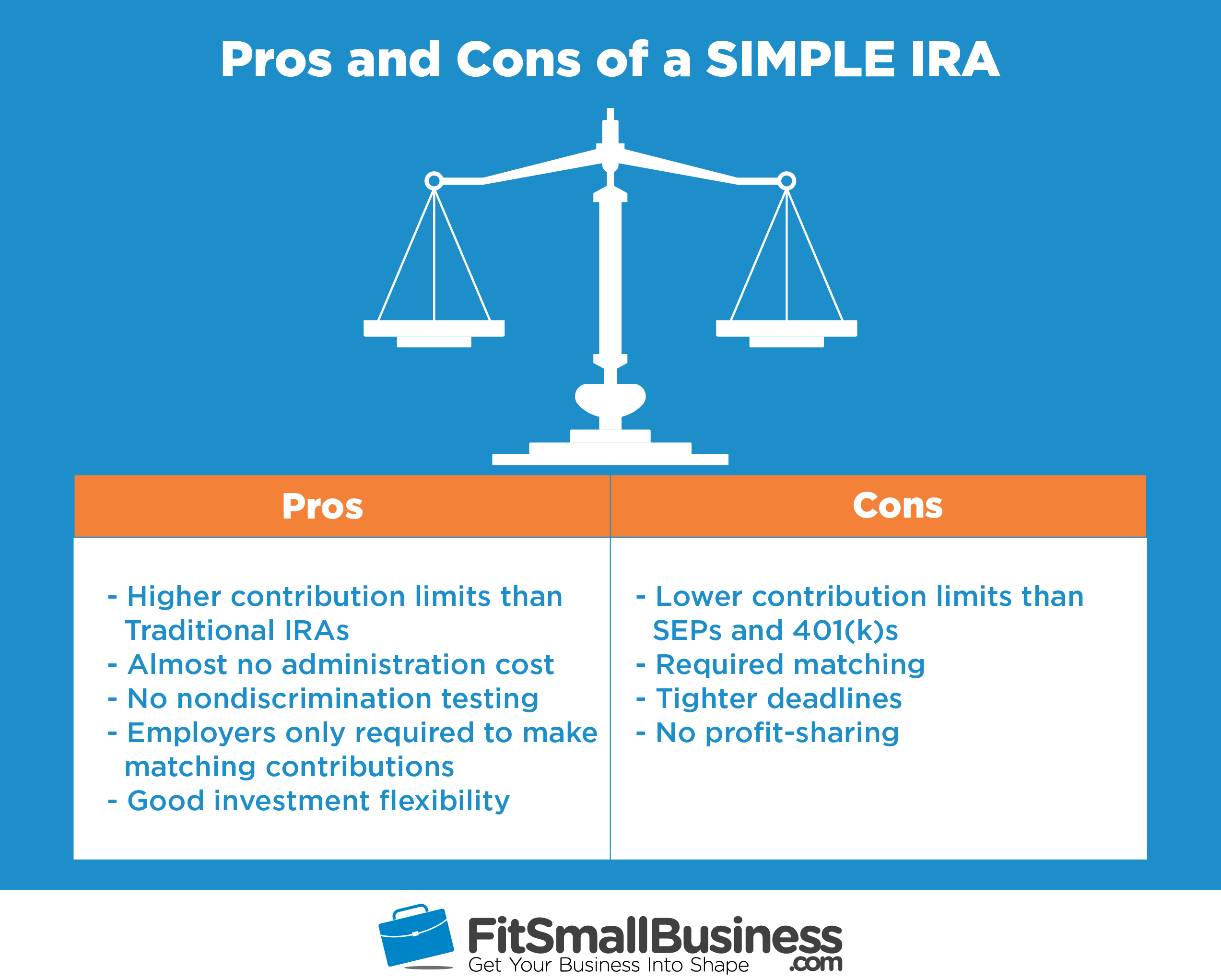

Contribution limits for these are different from the more popular iras above; For 2023, contributions cannot exceed $15,500 for most people.

This Amount Has Slightly Increased From The 2023 Simple Ira Contribution Limit Of $15,500.

In 2023, simple iras allow for employee contributions up to $15,500 annually ($19,000 for those 50 or older);

As Of 2024, For Employers With 25 Or Fewer Employees, Employees Are Able To Contribute Up To.

Effective january 1, 2024, employers are permitted to make additional contributions to each participant in a simple plan in a uniform manner, provided that.

Simple Ira Or Defined Contribution Plan, Such As A 401(K), You Can Convert It To A Roth Ira Through.

Images References :

Source: tobiqkarlie.pages.dev

Source: tobiqkarlie.pages.dev

Maximum Ira Contribution 2024 Over 55 Rules Dana BetteAnn, The annual contribution limit for a traditional ira in 2023 was. Those numbers increase to $16,000 and $19,500 in 2024.

Source: www.advantaira.com

Source: www.advantaira.com

2024 Contribution Limits Announced by the IRS, The current and recent annual employee deferral amounts (contributions) from their salary, as set by the irs, is shown in the. Those numbers increase to $16,000 and $19,500 in 2024.

Source: robbyqcarmelia.pages.dev

Source: robbyqcarmelia.pages.dev

Simple Ira 2024 Contribution Deadline Ibby Theadora, The current and recent annual employee deferral amounts (contributions) from their salary, as set by the irs, is shown in the. That's up from the 2023 limit of $15,500.

Source: edeacorenda.pages.dev

Source: edeacorenda.pages.dev

What Is The Max Simple Ira Contribution For 2024 Elana Harmony, Max sep ira contribution 2024. Individuals under 50 years of age have a $16,000 annual contribution limit in 2024, while those aged 50 or older can invest up to $19,500 in their.

Source: www.youtube.com

Source: www.youtube.com

2024 IRA Maximum Contribution Limits YouTube, What are the contribution limits for a simple ira plan? An employee under age 50 can contribute up to $16,000 to a simple ira in 2024.

Source: suellenwmyrna.pages.dev

Source: suellenwmyrna.pages.dev

How Late Can I Contribute To My Ira For 2024 Gilli, Contribution limits for these are different from the more popular iras above; What are the contribution limits for a simple ira plan?

Source: inflationprotection.org

Source: inflationprotection.org

2024 Max Contribution Limits for IRAs and 401(k)s Inflation Protection, Max ira contribution 2024 over 50. You may contribute up to $16,000 to a simple ira in 2024, up from $15,500 in 2023.

Source: smallbizgrowth.net

Source: smallbizgrowth.net

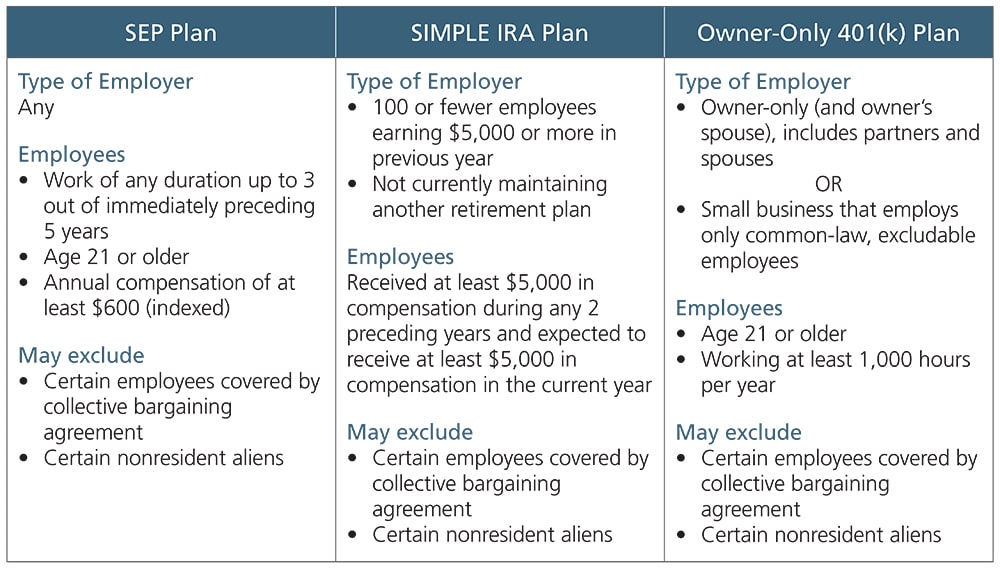

SIMPLE IRA Rules, Providers, Contribution Deadlines & Limits Small, To that end, your contribution cannot exceed your taxable compensation for the year. As a couple, you can contribute a combined total.

Source: giselaqermentrude.pages.dev

Source: giselaqermentrude.pages.dev

Sep 2024 Contribution Limit Irs Ceil Meagan, For 2024, the annual contribution limit for simple iras is $16,000, up from $15,500 in 2023. Simple ira maximum contribution limits for 2023 and 2024.

Source: www.msn.com

Source: www.msn.com

SIMPLE IRA Contribution Limits for 2024, Individuals under 50 years of age have a $16,000 annual contribution limit in 2024, while those aged 50 or older can invest up to $19,500 in their. The 2024 simple ira contribution limit for employees is $16,000.

$16,000 ($19,500 For Individuals Aged 50 Or.

The 2024 simple ira contribution limit for employees is $16,000.

Ira Contribution Limits For 2023 And 2024.

The contribution limit for a simple ira plan in 2024 is $16,000 for employees, with an additional catch.