Tax Deadline Extended 2024 California

Tax Deadline Extended 2024 California. The new tax deadline extension means some taxpayers and businesses who would have had an oct. Here's a list of states with irs tax deadline extensions for 2023 federal income tax returns (normally filed in early 2024) and other details you need to know if.

The irs today announced that taxpayers affected by winter natural disasters in 55 california counties qualify for an extension to file and pay their tax year 2022 federal. However, california grants an automatic extension until october 15, 2024 to file.

There Is A Difference Between How California Treats Businesses Vs Federal.

Our due dates apply to both calendar and fiscal tax years.

Your Payment Is Still Due By April 15.

California grants an automatic filing extension for state taxes to oct.

The Irs Today Announced That Taxpayers Affected By Winter Natural Disasters In 55 California Counties Qualify For An Extension To File And Pay Their Tax Year 2022 Federal.

Images References :

Source: www.cpapracticeadvisor.com

Source: www.cpapracticeadvisor.com

Busy Season Survival Secret? CRM! CPA Practice Advisor, California grants an automatic filing extension for state taxes to oct. As a result, affected california businesses and individuals now have until june 17, 2024, to meet various tax filing and payment obligations, including filing their.

Source: www.lehighvalleylive.com

Source: www.lehighvalleylive.com

Today’s holidays for April 18 See the 14 national holidays to, 16, 2023, extended tax filing deadline now have until feb. 27, 2024 1:08 pm pt.

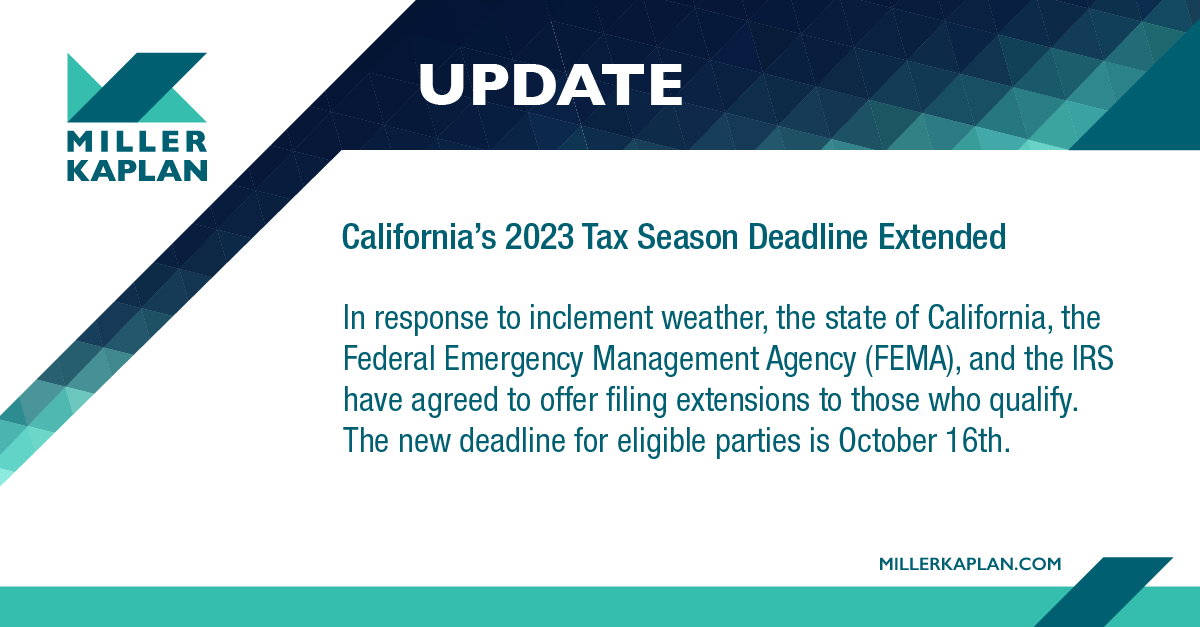

Source: www.millerkaplan.com

Source: www.millerkaplan.com

Reminder California’s 2023 tax season deadline extended Miller Kaplan, California is extending the tax filing deadline for californians impacted by december and january winter storms to. The due date to file your california state tax return and pay any balance due is april 15, 2024.

Source: heritagetaxcompany.com

Source: heritagetaxcompany.com

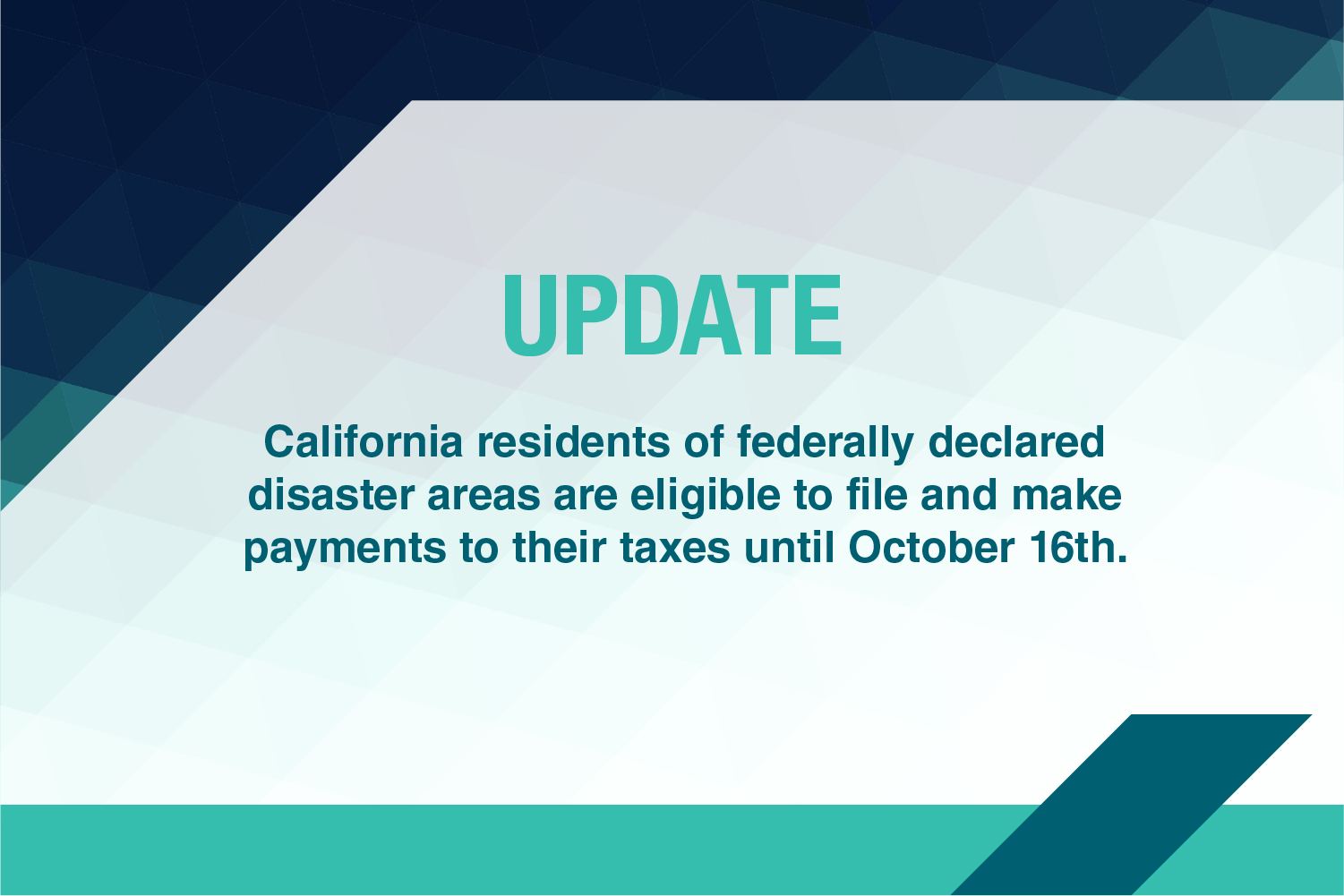

Tax Deadline 2023 Key Dates and Deadlines Heritage Tax Company, As a result, most individuals and businesses in california will now have until nov. What you need to know:

Source: www.marca.com

Source: www.marca.com

Tax Day 2023 Why aren't taxes due on April 17? Marca, 27, 2024 1:08 pm pt. The due date to file your california individual or fiduciary income tax return and pay any balance due is april 15, 2024.

Source: abc11.com

Source: abc11.com

Tax Day 2019 Freebies IRS got you stressed? Relax with these deals, Individual income tax returns and payments normally due on april 15, 2024,. As a result, most individuals and businesses in california will now have until nov.

Source: www.holbrookmanter.com

Source: www.holbrookmanter.com

Tax Deadlines for Q1 of 2022 Holbrook & Manter, As a result, most individuals and businesses in california will now have until nov. 21, 2024, and before june 17, 2024.

Source: www.millerkaplan.com

Source: www.millerkaplan.com

Reminder California’s 2023 tax season deadline extended Miller Kaplan, However, california grants an automatic extension until october 15, 2024 to file. Your payment is still due by april 15.

Source: abc30.com

Source: abc30.com

When are my taxes due? California tax deadline extended to October 16, However, california grants an automatic extension until october 15, 2024 to file. 16, 2023 for most california counties.

Source: tsielepis.com.cy

Source: tsielepis.com.cy

tax return deadline extended Costas Tsielepis & Co, Washington — the internal revenue service announced today tax relief for individuals and businesses in parts of california affected by severe storms and. The due date to file your california state tax return and pay any balance due is april 15, 2024.

For Example, An S Corporation's 2023 Tax.

16, 2023, extended tax filing deadline now have until feb.

What You Need To Know:

San diego county residents and businesses now have until june 17 to file individual and business tax returns and pay federal taxes, the internal.